Use of Digital Identification in the Post-COVID World

COVID-19 has disrupted the routine proceedings of numerous industries. Ensuing a state of chaos globally, the pandemic has changed the way things work forever. Most sectors have adopted the virtual approach to tackle adverse situations.

Affected by a ravaging pandemic that makes physical contact impossible, the global demand for digital processes has surged significantly. COVID has substantially sped up digitisation across industries..

The reason behind the same is simple – saving organisations from data breaches and frauds while their employees operate from their personal spaces that do not have sufficient anti-fraud checks in place. Amidst the confusion stirred by COVID, numerous instances of impersonation frauds, data theft, etc. have come to light.

Investments in the Digital ID Sector

Given the increase in fraudulent activities, , the World Bank announced a sum of 143 million dollars, supporting identity management systems and digital transformation.

The primary intent behind the move was to streamline the identification procedures, allowing quick services deployment to the public.

New Approaches Based on the Risks Involved

The standard digital KYC procedures involve face-to-face meetings, but the same is not possible due to the COVID 19 pandemic. Numerous businesses are facing difficulties in completing users’ KYC.

On 1st April 2021, the FATF stated that governments, businesses, and financial institutions must collaborate to tackle the situation. A little after that, regulators throughout Asia and other continents reiterated support for scalable approaches regarding KYC compliance. Pursuing risk-based approaches with multiple stations to digitally facilitate entity reporting and confirmation became the first step for many institutions.

Another instance was noted in Hong Kong with the Hong Kong Monetary Authority (HKMA.) HKMA advised SVFs (stored value facilities) and institutions to formulate techs that bode with social distancing and allow remote account opening and onboarding.

On 27th April 2021, India’s security regulators encouraged the use of tech to keep up with AML needs within the investor KYC procedure. This includes liveness checks, electronic signatures, and video identity verification. The move followed another relaxation made on 30th March, where KYC guidelines allowed overseas portfolio investors to renew registrations by sending scanned copies of the documentation.

Are these Changes Permanent?

With all the digital modification around the market, it is viable to ask – will these changes remain forever? Let us dig a little deeper on the subject.

The initiatives taken by the Indian security regulators might be temporary, but they can significantly reduce risks if executed right. Investment in in digital ID verification technology can outperform legacy processes used in institutions.

A great example would be document verification with high-end smartphones cameras. Comparing it to eyeball tests in branches prove how easy it is to identify altered documents.

By 2022, almost 65% of the global GDP might be digitised (International Data Corporation’s data.) Regarding the digital ID systems, the FATF stated that as technology and systems mitigating fraud risks and money laundering develop, AML and CDD control will strengthen. It will also increase monetary inclusion while reducing expenses for regulated personalities and improving user experience.

Change is Not Always Bad

Services like video KYC solution, risk screening, and document proofing are already available in the market. The database at the World-Check Risk Intelligence covers every sanctioned global entity. It also accounts for undesirable media screening functionalities to locate upcoming risks.

Choosing a digital ID service or system is only possible after comprehending the ideas driving the solutions. This way, well-educated business decisions will become a norm, reducing legal, reputational, and regulatory risks worldwide.

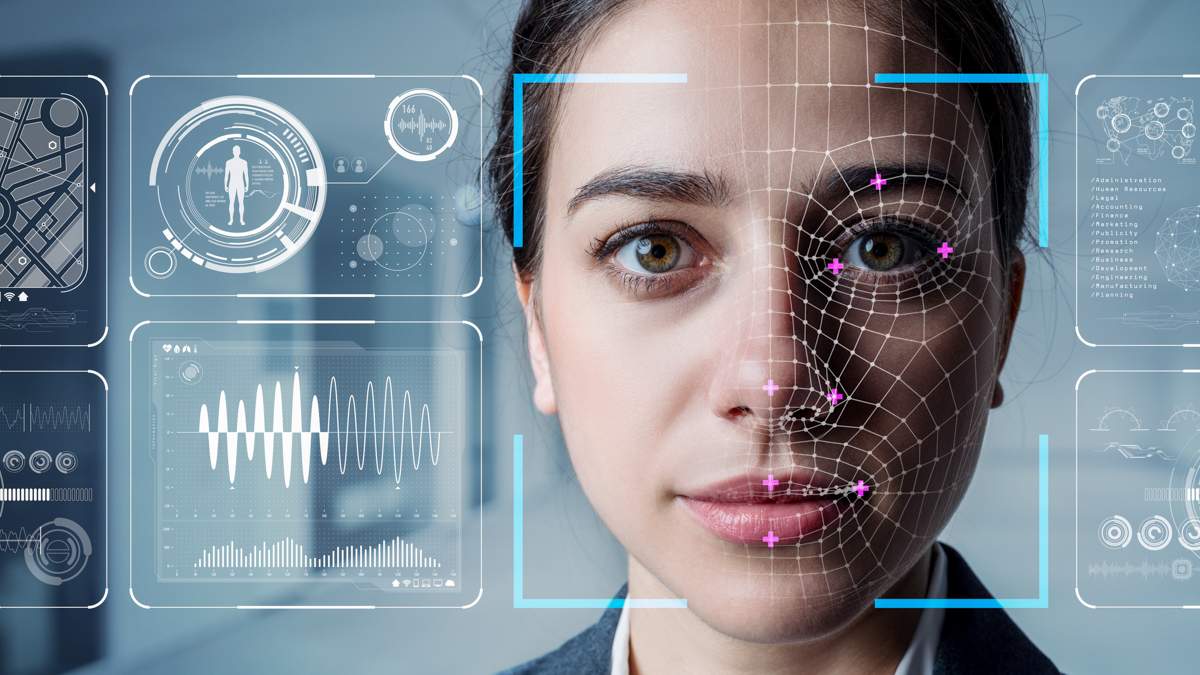

Governments will also experience an additional surge in demand for digital signatures and IDs. With modern apps and businesses trying to cope with social distancing, such measures will become a necessity. There are already ventures like ours that offer AI-powered identity verification services. Based on liveness detection, OCR capabilities, and geotagging, AuthBridge can render undertake ML-powered KYC for businesses.

Wrapping Up

While the pandemic has changed numerous routine proceedings throughout the globe, some of the new practices will accompany us in the future too. Digital ID verification will be one of the practices, making it into the post-COVID world.

The time for its mass adoption was already impending, but the pandemic preponed the trend by several years. Reach out to us at AuthBridge for all your KYC needs. We are already offering AI-based online ID verification solutions as the sector seems to be moving towards complete digitisation.